NaviNet®: Quick Access

Instantly access claims, preauthorization details, member benefits and eligibility and more functionality with NaviNet, our self-service tool for providers.

Starting Nov. 1, 2023, please use NaviNet exclusively for these services:

- In-Network Providers will need to submit appeals or reconsiderations in NaviNet.

- In-Network Providers will be redirected to NaviNet to check for appeal or reconsideration status.

- Customer Service will redirect providers to NaviNet for all claim status regardless of submission date.

- Remittance Advice (RAs) requests will continue to be redirected to NaviNet.

Self Service:

NaviNet is an easy-to-use, secure portal that links you, our provider to us, BCBSNE. With NaviNet web-based solutions we can share critical administrative, financial, and clinical data in one place.

This tool helps you manage patient care with quick access to:

- Verify member eligibility

- Request an authorization

- Request preservice review for out-of-area members

- View claim and payment details

- View documents

- Investigate and follow-up on claim investigations

- Appeal a claim and view existing appeals

- Access remittance advice details

- Access fee schedules

- View claim return letters

- Review your provider information

For written instructions on how to access the information above, please log in to NaviNet and use this link for the BCBSNE user guides.

If you prefer eLearning video tutorials with step-by-step instructions these are available in our Provider Academy. Visit NaviNet Quick Access for FAQs for our most commonly asked questions to improve your self-service experience.

NaviNet helps speed up the provider-health plan connection and can often replace paper transactions. If you are not a NaviNet user, learn more about NaviNet.

Who can access NaviNet?

Participating health care and dental providers, and non-participating health care providers within the state of Nebraska who have their information on file with BCBSNE can enroll for access.

Is there a cost to access NaviNet?

No. BCBSNE offers the NaviNet features and functionality at no charge.

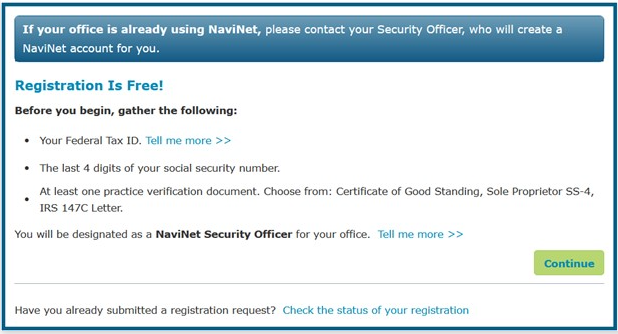

Registration process

- Simplified validation steps: Providers will now complete an "about me" quiz and submit a single business document. Successful completion can lead to registration approval within 24-48 hours.

- No initial phone calls: If you pass validation, no phone call is needed. If additional documents are required, you'll be notified via email. Only if there's no response will NH make up to three phone call attempts before canceling the request.

- Accurate contact information: NH will use the phone number you provide during registration, ensuring no mismatched numbers.

- Consistent verification forms: All applicants, including third parties, will follow the same verification process.

- New registration screen features:

- The first screen now includes additional bullet points for the new process.

- The "About You" page has two new fields:

- A "practice verification document" is required for all registrations.

- Successful identity verification requires matching data on file and correct answers to a 3-question quiz.

How do I register with NaviNet?

Each office must have a minimum of one Security Officer who is responsible for registering with NaviNet, adding users to the account, and granting user access. Your designated security officer should go to https://register.navinet.net/ to begin the registration process.

- Registration requires a Tax ID and email address.

- Each user will have their own username and password. No sharing is allowed.

- Users have 60 days to log in for the first time before they will become disabled.

- Users should see their Security Officer to have their password reset if they become disabled.

- Provider Registration Flyer

I am already registered with NaviNet. Do I have access to BCBSNE information?

If you are an existing NaviNet user, and are either a participating BCBSNE network provider, or are a healthcare provider within the state of Nebraska, you should see Blue Cross Blue Shield of Nebraska as an option in your Health Plans List. If you are a non-participating provider, your office must be loaded on the BCBSNE provider file.

Our office outsources our billing and payment to a third-party billing service. Can a billing service register with NaviNet?

Yes, but for security, the registration process will include validation and authentication with the provider office before access is permitted.

Who should I contact if I experience any difficulties using NaviNet?

To report a technical problem, call 888-482-8057 – available Monday - Friday, 7:00 a.m. – 10:00 p.m. CT, Saturday, 7:00 a.m. – 2:00 p.m. CT.

Quickly check the status of a claim through NaviNet.

In response to your feedback, we are happy to provide enhancements to improve your service experience and provide efficient resolution of claim questions and inquiries.

Claims Investigation »

The new Claims Investigation tool is now available by logging into NaviNet.

The Provider Caller Guide will help you discover the additional information we made available.

After you have attempted to resolve your questions/issues via NaviNet Claim Investigation/Customer Service and need further assistance, you may submit an Advanced Provider Inquiry using NaviNet. Please include any inquiry or reference numbers with a summary of your concern.

If you have already tried NaviNet, for Federal Employee Plan claim inquires only, please contact our Federal Employee Customer Service team at 800-223-5584 or 402-390-1879.

For 2024 BCBSNE Medicare Advantage claims (Y2MN or YMAN only), please contact our Medicare Advantage Customer Service at 1-888-505-2022 and select the correct option for 2024 information.

For 2025 BCBSNE Medicare Advantage claims (YMA4 and Y2M4 only) you can access this information at any time on NaviNet.

The best way to check member eligibility and review benefits is through NaviNet.

For services requiring preauthorizations, the most efficient way to submit a preauthorization request is online through NaviNet.

Log into NaviNet »To access fee schedules, please log in to NaviNet®.

For PHO providers, please contact your PHO representative directly.

For new providers without access to NaviNet, you will receive information on how to register with your BCBSNE acceptance letter. You may also watch the eLearning videos found in the Provider Academy.

To obtain patient documents such as a claim return letter, please log into NaviNet. You may also watch the eLearning videos found in the (link to the video page)

Provider Academy.

NantHealth Help Center

The NantHealth Help Center offers online resources to enhance your experience with NaviNet.

Please log in to NaviNet and use this link for the BCBSNE user guides.

Popular Topics:

- Access fee schedules

- Access remittance advice details

- Request an authorization

View Step-by-Step Instructions:

- Verify member eligibility (benefits, remaining visits, limitations and other payers)

- Authorizations (preauthorizations and preservice reviews)

- Claims and payments (appeals, investigations and notifications

For additional guidance, see the eLearning videos and Provider FAQs in our Provider Academy.